Railway transportation and infrastructure

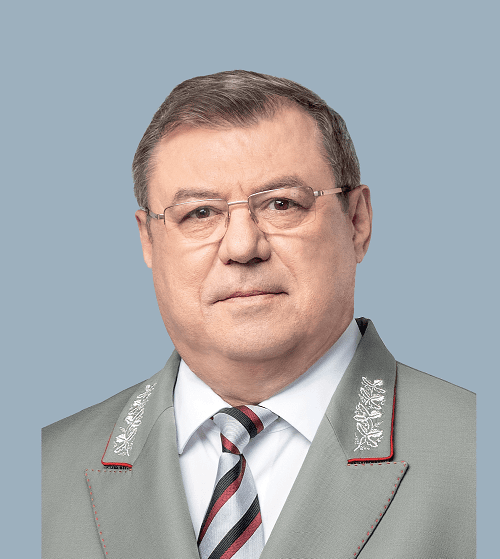

2019 saw a number of landmark events. In August, we completed the main phase of gauge conversion on Sakhalin. We have taken the first steps towards traffic control and further steps towards removing infrastructural restrictions as well as significantly improved the condition of the track structure, and are now working to renew power supply equipment. All development projects have supporting programmes in place. Large-scale investment projects are underway to ensure the necessary throughput capacities for prospective freight traffic. Our absolute priority is to increase the carrying capacities at BAM and Trans-Siberian Railway bottlenecks.”Anatoly Krasnoshchek First Deputy CEO of Russian Railways

2019 saw a number of landmark events. In August, we completed the main phase of gauge conversion on Sakhalin. We have taken the first steps towards traffic control and further steps towards removing infrastructural restrictions as well as significantly improved the condition of the track structure, and are now working to renew power supply equipment. All development projects have supporting programmes in place. Large-scale investment projects are underway to ensure the necessary throughput capacities for prospective freight traffic. Our absolute priority is to increase the carrying capacities at BAM and Trans-Siberian Railway bottlenecks.”Anatoly Krasnoshchek First Deputy CEO of Russian Railways

The railway transportation and infrastructure segment covers core business units engaged in railway transportation management, maintenance and development of infrastructure and locomotive fleet. The Company’s operating and financial performance is directly linked to their efficiency, effectiveness and technical cooperation.

- The Company ensured the export handling of coal to the ports of Russia at the request of key coal companies, including the enterprises of Kuzbass. More than 7 mt of coal was exported (up 7.5%), with an almost 12% growth in shipments to the ports of the North-West.

- Handling of containerised cargo grew by 13.1% vs 2018.

- The total freight turnover amounted to 3,305 m tkm, flat vs 2018.

- The loaded car delivery speed increased to 395 km/day, up 1.3% vs 2018.

- The share of shipments delivered within required period increased by 1.7 pp vs 2018, reaching 98.4%.

- The average weight of a freight train was 4,090 t, up 0.3% vs 2018.

- The average daily performance of a freight train locomotive reached 1,610 thousand gross tkm, up 1.3% vs 2018.

- The railway infrastructure on the island of Sakhalin was converted, resulting in an expansion of the 1,520 mm gauge network by more than 770 km.

- The interval between the MCC trains in the same direction was reduced to four minutes.

Key focus areas of the Long-Term Development Programme

Key initiatives in rail transportation and infrastructure development include:

- developing operating domain-centred transportation management principles across the Russian Railways network;

- creating dedicated infrastructure for passenger and freight traffic;

- boosting efficiency of low intensity railway lines;

- enhancing transportation efficiency through quality improvements in utilisation of the rolling stock;

- developing marshalling yards;

- improving management of the freight car fleet;

- bolstering utilisation efficiency of mainline and shuntering locomotives and locomotive crews;

- upgrading railway tracks applying new technology and using elements and structures of equally high quality to reduce costs associated with the infrastructure maintenance life cycle;

- introducing automation equipment with moving blocks within sections, including a distributed computer-based interlocking system at stations with identification of main tracks, differentiated departure sections and automatic cab signalling;

- establishing extended guarantee sections ensuring safe passage of freight trains;

- creating an operating domain-centred model for operation of work trains and diagnostic machinery;

- removing energy-related restrictions;

- preparing infrastructure facilities for passage of heavy-duty and long trains;

- streamlining planning for repairs and maintenance of infrastructure facilities and associated scheduling processes;

- improving train composition planning and train passage management systems;

- using natural gas as a motor fuel, gradually expanding the use of gas powered locomotives (gas turbine locomotives, gas powered diesel locomotives used in shuntering operations), while also working to improve design and increase efficiency at locomotive plants when developing modern servicing stations and LNG refuelling mechanisms.

Russian Railways’ goals for developing railway infrastructure until 2025:

- achieve an increase in the throughput capacity of the Baikal—Amur and TransSiberian Railways to 180 mt by 2024;

- boost the throughput capacity of the rail infrastructure serving ports of the Azov and Black Seas;

- reduce container travel times from the Far East to Russia’s western border to seven days and achieve a fourfold increase in the transit container traffic by 2024;

- develop high-speed and ultra high-speed railway services between and within major cities and metropolitan areas;

- develop transportation services between regional administrative centres and other cities of major economic activity;

- create multimodal freight transportation and logistics hubs.

Repairs and upgrade of infrastructure facilities

In 2019, expenses on all types of track repairs amounted to RUB 145 bn, which is 10.8% higher than in 2018. Capital renovation in 2019 covered 6,017.2 km of tracks.

2019 became a milestone year for Sakhalin as its railway tracks were converted to the 1,520 mm gauge. Previously, the island’s rail network operated on the 1,067 mm Cape Gauge widely used in Japan.

The conversion process that required several temporary closures of tracks for passenger and freight traffic in 2019–2020 consisted of six stages, five of which were completed in 2019. The Kholmsk–Arsentievka and Korsakov–Nogliki sections saw freight and passenger transportation launched since 1 September 2019. The Kholmsk–Shakhty line will start operating on the 1,520 mm gauge in August 2020.

Improving performance at operating domains

Transitioning from region-based management of the transportation process to the operating domain–based planning and organisation of train traffic is the key area of the Company’s operations development. It boosts efficiency and helps to clearly separate unit functions and responsibilities.

Optimisation of the freight traffic schedule

The main function of the train schedule is to maximise the infrastructure efficiency for the required throughput and carrying capacity, ensure the target volume of freight traffic and increase the schedule and mean speed.

Key measures to optimise schedule:

- arrange traffic of heavy-duty trains weighing 8–9 kt;

- ensure passage of coupled trains at railway sections with high traffic density;

- establish new guarantee sections ensuring safe passage of loaded and empty container platforms as part of container trains.

New technological solutions allowed the Company to increase the speed of transit freight transportation across the country. The average speed of transit container trains in 2019 stood at 1,097 km/day, or 17.8% above the target set in the Comprehensive Plan for Upgrading and Expanding Core Infrastructure (931 km/day).

Traction stock in 2019

As at the end of 2019, the operating locomotive fleet of Russian Railways comprised 14,031 units (down 1.7% vs 2018), including:

- 7,592 freight train locomotives (–1.4%);

- 1,562 passenger train locomotives (–0.3%);

- 1,726 service train locomotives (+0.1%);

- 3,151 locomotives involved in special and other shunting operations (–4.0%).

As at the end of 2019, the active locomotive fleet of Russian Railways comprised 10,108 units (down 1.1% vs 2018), including:

- 5,714 freight train locomotives

(—0.3%); - 742 passenger train locomotives

(—0.2%); - 976 service train locomotives (+2.0%);

- 2,676 locomotives involved in special and other shunting operations (–4.1%).

In 2019, the Company purchased 738 locomotives as part of the investment programme. Additional 3,236 locomotives will be acquired in 2020–2025.

Improving locomotive utilisation

Measures to improve locomotive fleet utilisation in 2019:

- optimisation of 103 units of operating freight locomotive fleet by improving daily performance;

- optimisation of 91 units of operating shunter fleet involved in special shunting operations;

- optimisation of 19 units of operating shunter fleet involved in other shunting operations;

New technical requirements have been developed for the new generation freight locomotives, including electric and autonomous locomotives, to account for improved transportation technologies. Compared with the locomotives currently in use, the new generation mainline freight locomotives will provide for single traction, multiple-unit, and distributed traction systems. They will have greater power and traction and longer repair intervals.

In 2019, 710 locomotives were purchased under supply contracts with compulsory service during the life cycle. This scheme makes locomotive manufacturers more responsible for the technical condition of rolling stock, ultimately reducing downtime.

In 2019, Russian Railways retrofitted its locomotives with safety devices as part of the investment programme. Driver’s digital route sheet is implemented across the railway network.

Developing heavy-duty traffic

Heavy-duty traffic and higher weight standards of freight trains are key to optimising the transportation process.

Russian Railways continues to develop heavy-duty traffic. Over the year, 162,700 trains weighing over 6 kt were dispatched, allowing for the transportation of additional 30 mt of cargo on the basis of the same infrastructure.

The average train weight across the network increased toThe Intelligent Railway Transportation Management System (IRTMS) is aimed at creating an automated centre to support decision-making enabling real-time process management, operation planning, and high-level modelling and forecasting. The project is still in progress, but certain subsystems already operate on parts of the network, including the October Railway and the Eastern Operating Domain.

In 2019, RRC-1 and RRC-2, subsidiaries of Russian Railways used to repair freight rolling stock, showed improved financial and operational performance. The growth was achieved by expanding the client portfolio, improving service quality and optimising costs.

RRC-1

Income for the reporting period amounted to RUB 28.5 bn (up 6% vs 2018), sales revenue stood at RUB 1.1 bn (flat vs 2018), and net profit totalled RUB 407 m (down 14% vs 2018).

RRC-2

In 2019, RRC-2’s revenue and net profit increased by 22% and 13%, to RUB 18.6 bn and RUB 559 m, respectively.